property tax on leased car in va

The tax is levied as a flat-rate percentage of the value and varies by county. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

In order to qualify for tax relief your vehicle.

. 4 Rental Tax on the rental of any vehicle with a gross vehicle weight or gross combined weight rating of 26000 pounds or less. TAXABLE In the state of Virginia they are subject to a motor vehicle rental tax. A motor vehicle has.

Ownership and Tax Statements A. We are open for walk-in traffic weekdays 8AM to 430PM. When a property is sold leased or rented it is generally taxed.

In car leasing as in buying there can be charges fees costs and taxes that often surprise newcomers. This fee is typically in the range of 495 to 995 with averages in the 595-795 range depending on the car company. A rental agreement requires you to pay 3 of the total lease payment plus any applicable vehicle registration and.

It should be noted that rental of any daily rental vehicle subject to additional tax and additional fee. For example in Alexandria Virginia a car tax is 5 per 100 of the estimated value while in. Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January 1.

Code 581-3523 is determined by the Commissioner of the Revenue COR of the county city. In general a qualifying vehicle Va. The Personal Property Tax Relief Act of 1998 PPTRA provides tax relief for vehicles locally registered within the Commonwealth of Virginia.

Loudoun County levies a tax. Ownership and Tax Statements. Use our website send an email or call us weekdays from 8AM to 430PM.

Vehicles leased by a qualified military service member andor spouse will receive a 100 state vehicle tax subsidy PPTRA as a tax credit on the first 20000 of assessed value. If you buy the vehicle you must re-title the vehicle in your name and pay Motor Vehicle Sales and Use Tax SUT which is based on the residual value paid by the lessee to the lessor. 4 Local Tax on the rental of any vehicle regardless of weight.

703-222-8234 TTY 711. On January 1 vehicle owners and leasing companies in Virginia are required to pay an annual personal property tax on their vehicles based on their worth. For example in Alexandria Virginia a car tax runs 5 per 100 of assessed value while in Fairfax County the assessment is 457 per 100.

The tax is levied as a flat-rate percentage of the value and varies by county. High-end luxury vehicles have higher acquisition fees than lower priced. So if you live in a state with a high sales tax its important to factor that into.

Determining Qualifying Vehicles for Personal Property Relief. For example in Alexandria Virginia a car. A leased vehicle is any vehicle used by a person or entity lessee offering some form of compensation to use the vehicle and who has an agreement with the owner of the.

For example in Alexandria Virginia a car tax is 5 per 100 of the estimated value while in Fairfax County.

When Should You Lease Your Car Here S The Best Time To Do It Shift

Virginia Department Of Motor Vehicles

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Pay Personal Property Tax Help

Insuring A Leased Vehicle Bankrate

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

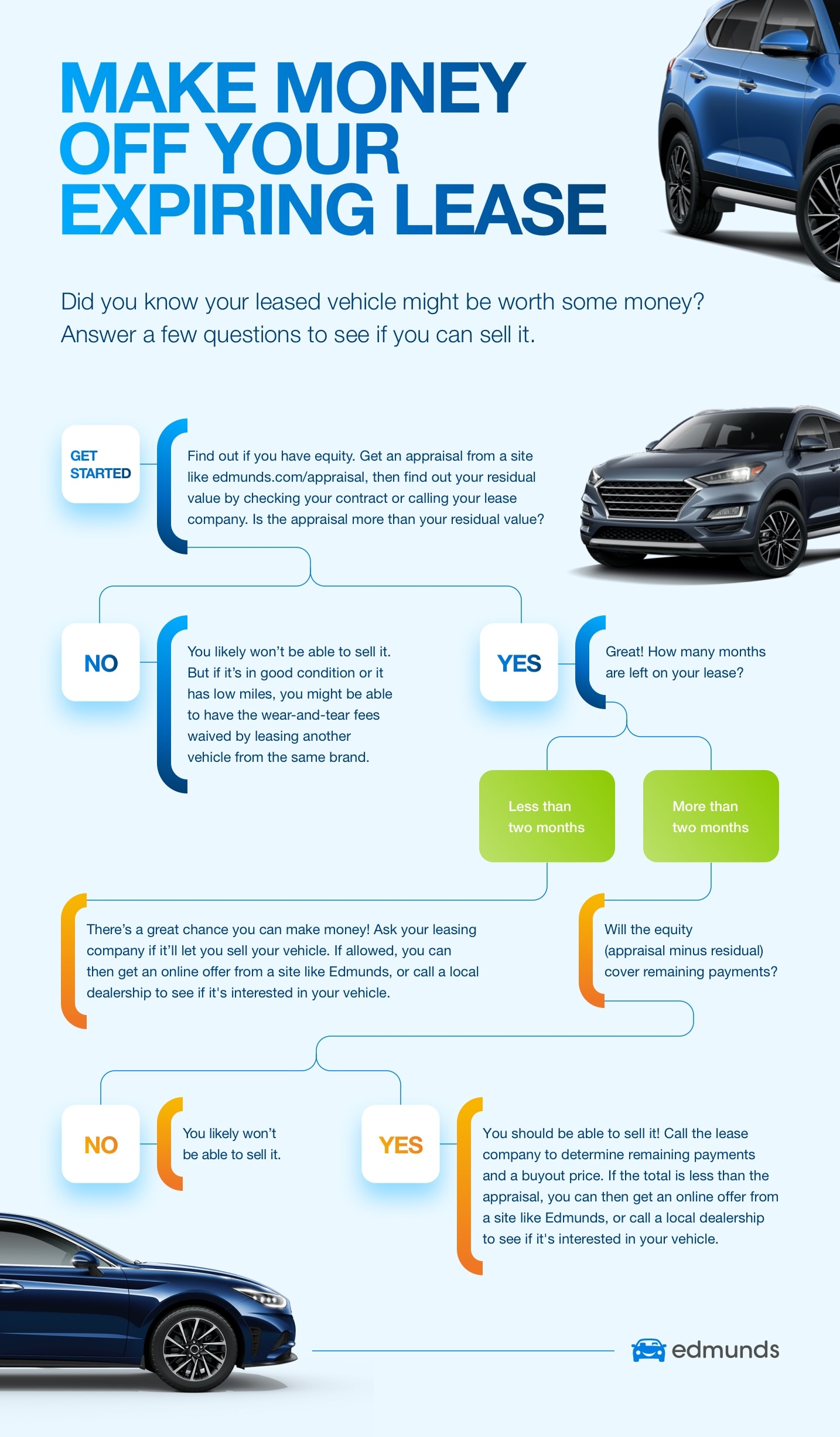

Car Leasing Return Lease Return Vs Selling A Lease Car Edmunds

Free West Virginia Bill Of Sale Forms 3 Pdf Eforms

105 N 17th St Richmond Va 23219 Loopnet

Vehicle Taxes Fees Tax Administration

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

How Much Virginia Personal Property Tax Bill We Pay For Multiple Cars Youtube

Vehicle Taxes Frequently Asked Questions Tax Administration

Insurance For Leased Cars Vs Financed Cars Allstate

Is It Better To Buy Or Lease A Car Taxact Blog

2013 Tax Facts General Information About Fairfax County Taxes

Requirements Before Registering Your Vehicle